A survey of bank charges by the Bank of Ghana conducted in the first quarter of 2021 has revealed that majority of the 23 banks operating in the country do not charge customers’ fees for withdrawing cash from an Automated Teller Machine (ATM). However, almost all of them charge fees for issuance and maintenance of …

Month: August 2021

The Bank of Ghana in its latest inflation outlook has confidently forecasted headline inflation to remain within the medium-term target band of 8±2 percent despite it inching up in the past two months, but has expressed concern about risk from the fiscal side. Domestic price pressures moderated during the second quarter of 2021, causing headline …

The latest payments platforms report released by the Bank of Ghana, covering the first half of 2021 has disclosed that mobile money transactions has retained its place as the most preferred mode of transferring money, ahead of cheques. Indeed the gap between mobile money and cheques continues to grow, measured by both number of transactions …

A new campaign to get the Ghana Tax Exemptions Bill passed into law by Parliament has begun. The bill has been stuck between cabinet and Parliament since 2019 despite overwhelming support by its passage into law by economists, financial analysts, public policy commentators, civil society organizations and the media, in order to plug a glaring …

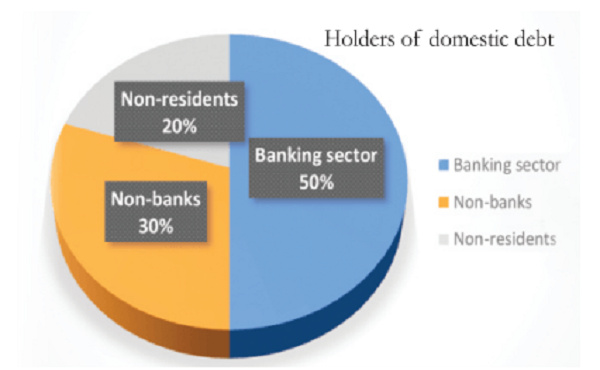

Analyst bemoans crowding out effect on private sector The country’s banking sector holds half of the country’s domestic debt – meaning the financial sector has become more comfortable investing in government instruments than lending to the private sector, a situation that a financial analyst says is a threat to the recovery plan. According to the …

The Bank of Ghana has partnered with Giesecke+Devrient (G+D) to pilot a general purpose Central Bank Digital Currency (retail CBDC). G+D is providing the technology and developing the solution adapted to Ghana’s requirements, which will be tested in a trial phase with banks, payment service providers, merchants, consumers and other relevant stakeholders. To this end, …

The 2022 National Budget will be targeted at creating opportunities and providing solutions towards achieving a sustainable and broad-based economic growth without harming the climate or leaving families in poverty. According to the 2022-2025 Budget Preparation Guidelines, the approach of the budget which will be launched in November 2021 is to catalyse the private sector …

The Bank of Ghana has effectively been forced to halt further monetary easing for now as the latest consumer price inflation data from the Ghana Statistical Service, released on Wednesday last week, has revealed that Ghana’s inflation rate rose more than forecast in July after food, transport and housing prices surged. This confirms suspicions already …

The mobile money platform has solidified its position as the most widely used and accepted payment system in the country, as data from the Bank of Ghana shows its transactional value is bigger than all the others combined. According to the Summary of Economic and Financial report (July 2021), the mobile money payment platform has …

Even though the rollout of the mobile money platform since a decade ago has been largely successful, as it has widely gained acceptance, most transactions are still cash driven, a situation Bank of Ghana’s Director and Head of Payment Systems, Dr. Settor Amediku, says requires more collaboration of both the regulator and players to improve …