Lending rates demanded by commercial banks in Ghana will begin to be cut this week in response to the Bank of Ghana’s announcement, a week ago, of a 100 basis points cut in its key Monetary Policy Rate, bringing it down to 13.5 percent in a move that many had hoped for but few had …

Banks will soon adopt only the National Identification card as the primary source of documentation for banking transactions. This follows discussions between the banks, represented by the Ghana Association of Bankers, the National Identification Authority and the Bank of Ghana. The discussion is said to have reached an advanced stage and a roadmap on when …

The central bank has issued guidelines for Rural and Community Banks (RCBs), focused on de-risking that sector of the banking system. According to bank, the guidelines, issued last week, have been designed to provide a framework within which regulated RCBs will establish and embed a culture of risk management in their institutions. Additionally, they will …

Contrarily to the hesitation of many banks and financial institutions to advance support to the agricultural sector, the Nsoatreman Rural Bank Limited at Nsoatre in the Sunyani West Municipality of the Bono Region has resolved to prioritise agricultural financing in the 2021 financial year. “The bank has started giving out more agric loans, particularly to …

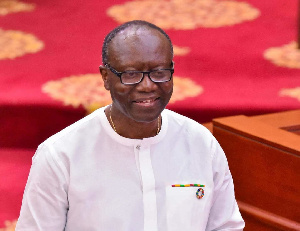

Finance Minister, Ken Ofori-Atta, has revealed that the National Development Bank is set to commence operations by the end of July. Delivering the State of the Nation Address in Parliament on Tuesday, March 9th 2021, the president of the Republic of Ghana, Nana Addo Dankwa Akufo-Addo mentioned that the establishment of the National Development Bank, under …

The latest data emanating from the Bank of Ghana through its Banking Sector Developments Report dated April 2021 shows how Ghana’s banking industry has gone about major restructuring of the respective balance sheets in response to the impacts of COVID 19 on the economy. The restructuring of their assets and liabilities has basically aimed to …

Banks wrote off a little above GH¢1.1 billion in the first two months of this year, according to the Profitability Statement of Banks published by the Bank of Ghana. The provisioning for bad debt was classified as loan losses, depreciation and others. It was slightly above the GH¢1.02 billion recorded during the same period last …

GCB Bank has described as false a publication by a body calling itself Good Governance Advocacy Group (GGAG), alleging that the bank’s Board has engaged in corruption, abuse of office, and conflict of interest. The bank has urged its customers and shareholders to disregard the publication, which has been circulated in some media outlets to …

The First Deputy Governor of the Bank of Ghana, Dr. Maxwell Opoku-Afari, says the regulatory environment for fintech has been revamped to ensure a more competitive and innovative industry. Speaking at the second edition of the Mobile Technology for Development Conference 2021, the Deputy Governor said this has better positioned the fintech industry to serve …

Accra, April 2, GNA – The Bank of Ghana (BoG) has joined the Basel Consultative Group (BCG), a global body that sets and implements standards on banking supervision. In a statement the bank said it was admitted into the global body, making Ghana one of four countries in Africa which are members of the BCG. …