Ghana’s quest for a national development finance institution to provide critical financing for economic development cannot be overemphasised. This is because the existing commercial banks have over the years not been able to deliver and adequately supported the country’s development process, partly due to the maturity expectation gap. “The maturity expectation of the depositor is …

The Supreme Court has dismissed a case filed by the Association of Finance House challenging the Bank of Ghana for issuing corporate governance directives for financial institutions, ruling that the regulator’s action was lawful. The Association of Finance House, in November 2020, brought an action in the Supreme Court of Ghana challenging the Bank of …

The Bank of Ghana (BoG) has said it would not renew licenses of susu collectors who are non-compliant with set regulations governing susu operations in the country. The Central Bank noted that the practice of susu collectors, taking money from individuals and keeping them in personal accounts or lending such monies to third parties is …

…launches ‘We Dey Everywhere’ campaign Fidelity Bank Ghana has further cemented its status as the country’s leader in Agency Banking with the launch of its ‘We Dey Everywhere’ Campaign. The campaign seeks to create awareness about the bank’s extensive network of community agents who are bringing banking to the doorsteps of Ghanaians across the country. …

Fidelity Bank has introduced the Fidelity Edwapa Account to provide customised financial services for self-employed individuals and sole proprietors. This account is accessible to individuals operating within both the formal and informal business sectors. The Fidelity Edwapa Account comes with enhanced features and benefits tailored to fit the unique business needs of self-employed individuals and …

The Nkoranman Rural Bank at Seikwa in the Tain district of Bono Region has posted satisfactory gains in its performance indicators to consolidate year-on-year-on growth. Amid the myriad of operational challenges that stemmed from the troubled macroeconomic environment, largely because of the coronavirus pandemic and the financial sector clean-up by the regulators, the bank remained …

Businesses must reduce their reliance on banks for funding and consider other sources of finance to support their operations, Paul Ababio, Deputy Director-General in Charge of Finance at the Securities and Exchange Commission, has observed. Speaking to Business24 in an interview, he said there are other avenues whereby especially small and medium enterprises can raise …

The Bank of Ghana (BoG) says financial institutions must, within 24 hours of receiving a complaint from a customer regarding the capture of a payment card by an Automated Teller Machine (ATM), take steps to identify the cardholder and further work expeditiously to return the card to the customer. The central bank, in a directive …

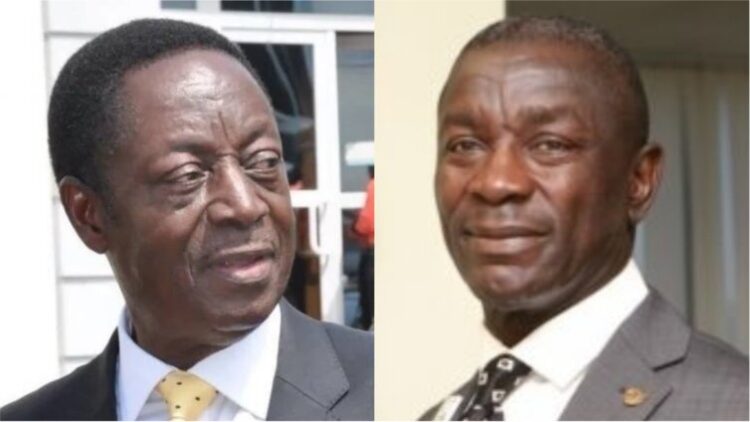

The Bank of Ghana has declined an invitation to appear before Parliament to assist it with investigations over the revocation of the banking licenses of Unibank and UT Bank. Writing through its lawyers, Bentsi-Enchill Letsa and Ankomah, the central bank explained that the petitioners, Prince Kofi Amoabeng and Dr Kwabena Duffour, the owners of the …

The central bank has abolished seven nuisance fees and charges as well as other practices in the banking sector, in a bid to ensure that the interests of customers of banks and Specialised Deposit-Taking Institutions (SDIs) are adequately protected. In a release issued last week, the Bank of Ghana said it has observed with concern …