The Chartered Institute of Marketing Ghana has released a ground breaking research driven survey report on customer satisfaction in Ghana’s banking sector The report, which was unveiled officially at the Coconut Grove Hotel in Accra a fortnight ago, is the first ever survey of customer satisfaction in a services industry in Ghana. It is not …

Data published by the Bank of Ghana has shown that growth in deposits of commercial banks have been fluctuating in the last eight months, with figures in August even showing a decline, a development banking consultant, Dr. Richmond Atuahene, has attributed to the difficulty private sector is facing in the current pandemic-hit climate. The Summary …

…to compensate for perceived high credit risk Data released last week by the Bank of Ghana on the lending rates demanded by commercial banks in Ghana reveal that the most banks are still demanding unusually high interest rate spreads between their cost of funds and the rates at which they are willing to give loans …

Managing Director of the Agriculture Development Bank (ADB), Dr. John Kofi Mensah, has said that banks are working together to close the wide gap that exists between policy and lending rates. Currently, the Monetary Policy Committee (MPC) of the Bank of Ghana has pegged the policy rate at 13.5 percent, whereas, average lending rate of …

Fidelity Bank has launched a digital self-onboarding solution for its innovative Smart Account, a minimum-effort ‘Know Your Customer’ (KYC) requirement account that was launched in 2014 to extend financial services to the unbanked and underbanked in Ghana. The new platform has made it easy to open a Fidelity Smart Account from any location using the …

The Bank of Ghana’s 2020 Banks & SDIs Fraud Report says the reported value of fraud for 2020 was GH₵1.0billion as compared to GH₵115.51billion recorded in 2019, and the central bank notes that this poses reputational risks to some banks. It is noteworthy that despite the increasing rate of fraud cases-valued at GH₵1.0billion, the losses …

A survey of bank charges by the Bank of Ghana conducted in the first quarter of 2021 has revealed that majority of the 23 banks operating in the country do not charge customers’ fees for withdrawing cash from an Automated Teller Machine (ATM). However, almost all of them charge fees for issuance and maintenance of …

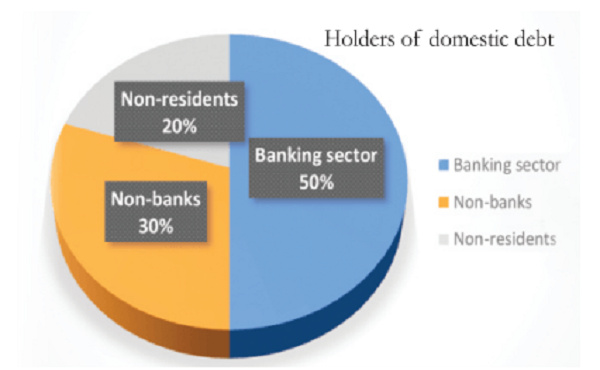

Analyst bemoans crowding out effect on private sector The country’s banking sector holds half of the country’s domestic debt – meaning the financial sector has become more comfortable investing in government instruments than lending to the private sector, a situation that a financial analyst says is a threat to the recovery plan. According to the …

The Bank of Ghana has partnered with Giesecke+Devrient (G+D) to pilot a general purpose Central Bank Digital Currency (retail CBDC). G+D is providing the technology and developing the solution adapted to Ghana’s requirements, which will be tested in a trial phase with banks, payment service providers, merchants, consumers and other relevant stakeholders. To this end, …

It is safe to say that banks are among the first adopters of digital transformation. Ghana’ banking sector has seen a lot of transformations over the past years. One may attribute this change to the digital drive from the regulator demanding that bank’s standardize their operations and to ensure that customers’ data are protected. Also …